USA Money Today – Henderson

Need quick cash in Sunrise Manor? We can help you get the money you need in as little as 30 minutes with our truck title loans. If you’ve been searching for “truck title loans near me”, look no further than USA Money Today. We have a quick and easy process to get the cash you need, and you can even keep your truck while you’re making payments.

Apply Now

Fast Approval & Get Your Cash Today

Local Truck Title Loan Company Near Sunrise Manor

Reputable Sunrise Manor Truck Title Loan Company Near You

USA Money Today is the leading provider of truck title loans in Sunrise Manor. We’re a local company that’s been helping people get the cash they need for over 20 years. We have a quick and easy process to get you the money you need. Contact one of our expert loan representatives today and get the cash you need in as little as 30 minutes.

Sunrise Manor Cost-Effective Truck Title Loans

First Class Truck Title Loans Company Near You

If you have found yourself in financial emergency, you’re not alone. Many people in Sunrise Manor are struggling to make ends meet. That’s where we come in. At USA Money Today, we offer fast and easy truck title loans that can help you get the cash you need when you need it most.

We have a quick and easy application process, and you can even keep your truck while you ‘re making payments. Contact us today and one of our expert loan representatives will help you get the cash you need in as little as 30 minutes. Our title loan company never imposes prepayment penalties, which is unusual for a title loan business. We maintain a high level of customer service and are always available to help you when you need it the most.

Truck Title Loan Eligibility

Check Our Truck Title Loan Requirements Near Sunrise Manor

You may be wondering, do I qualify for a truck title loan? The answer is probably yes. At USA Money Today, we have a quick and easy application process, and you can even keep your truck while you’re making payments. Simply show proof of income and insurance, and you’re good to go.

Only people who are at least 18 years old, own a paid-off automobile with a clear title, have a valid driver’s license, and display proof of income and insurance are eligible.

USA Money Today understands that people in Sunrise Manor are struggling to make ends meet. Our title loan company never imposes prepayment penalties, which is unusual for a title loan business. We maintain a high level of customer service and are always available to help you when you need it the most.

If you have any questions about our truck title loan process or eligibility requirements, please contact us today. One of our expert loan representatives will be more than happy to help you.

Key Details Regarding Our Truck Title Loans

Address Unforeseen Medical Expenses

Whether it’s an emergency surgery or ongoing medical treatment, we provide the financial support you need. We provide a simple, fast, and reliable way to ease your financial burden during challenging times.

Finance Home Repairs & Renovations

Transform your living space into a comfortable and inviting place without financial strain. We offer a flexible, hassle-free approach to funding your home projects, ensuring you can focus on creating the home you love.

Fund A Family Vacation Or Business Trip

Life is about experiences, and sometimes, a well-deserved vacation or an important business trip requires immediate funding. Luckily, our truck title loans help you seize those opportunities without financial worries.

Top-Rated Sunrise Manor Truck Title Loan Company

Apply For Your Truck Title Loan Online

With USA Money Today, you can apply for your truck title loan online in as little as five minutes. Just fill out our quick and easy online application and one of our expert loan representatives will contact you to discuss your options. With our fast and easy process, you can get the money you need in no time.

Client Testimonials

Highly Recommended Truck Title Loans Company

LoWe offer A+ quality on every service and provide outstanding customer service. We have an excellent track record of five-star ratings and reviews from clients who have had a pleasant experience with us. Our professionalism and dependability were recognized by the BBB, as well as our commitment to assisting each client in achieving financial success.

If you’re in a crunch and need a bunch? This is the place for you! Friendly staff that helps you navigate the process and then gets you on your way. Highly recommend!

One of those unforeseen issues popped up where I needed funds quickly. I called USA money and Gloria was absolutely amazing with helping me get the funds that I needed and made it so easy and hassle-free. Thank you Gloria and USA money.

This place is amazing very helpful , assisted me with getting h my loan and paying it back on the best time frame that fit my budget , Gloria was very helpful love her !!

We Welcome All Makes & Models Of Trucks

Your truck is more than just a vehicle; it’s a potential key to financial freedom. AT USA Money Today, we accept all truck makes and models, recognizing each one as a valuable asset capable of securing the loan you need. Whether your truck is a vintage workhorse or a cutting-edge powerhouse, we value your truck and offer loans that respect its worth. Our inclusive approach ensures that regardless of your truck’s brand or design, it marks the road to financial relief. Trust our streamlined loan application process to get the cash you need without any stress!

Convenient Truck Title Loans Near Sunrise Manor, NV

Trusted Truck Title Loans And Refinance Office Near You

USA Money Today provides fast cash title loans for almost any type of vehicle, no matter why you need quick cash. We accept trucks, RVs, campers, motorcycles, automobiles, and more if the title is clear and the automobile is paid off. Everyone may qualify regardless of your credit score or lack thereof!

Read Reviews For Our Truck Title Loans’ Clients

Visit USA Money Today to learn more about why we are so highly regarded by our clients.

Sunrise Manor’s Top-Choice Truck Title Loans Office Near You

USA Money Today is Sunrise Manor’s leading truck title loan company, we offer fast and easy truck title loans that can help you get the cash you need.

Five-Star Rated Truck Title Loans Company Near You

Our application for five star rated truck title loans is accessible online or in person, regardless of your financial background, at USA Money Today!

Truck Title Loan Office With Fast Application And High Approval Rate

There’s no need to be concerned about your credit score or financial stability. Anyone can visit USA Money Today and qualify for a truck title loan.

Truck Title Loans Company With Calculator Near Sunrise Manor

Our title loan agents are trustworthy, professional, and consistent in all our transactions.

Truck Title Loans Center With Affordable Rates

If you’re interested in refinancing an existing truck loan, visit USA Money Today to know more about our rates.

FAQs About Our Truck Title Loans

Contact Our Loan Office & Get Your Truck Title Today!

High-Quality Trucks And Vans Title Loan Company

If you have any queries about your application, please do not hesitate to contact one of our Sunrise Manor loan experts. We are here for you 24 hours a day, 7 days a week to assist you in gathering the information and submitting your application. Our payback terms are reasonable, and our interest rates are among the lowest in the industry!

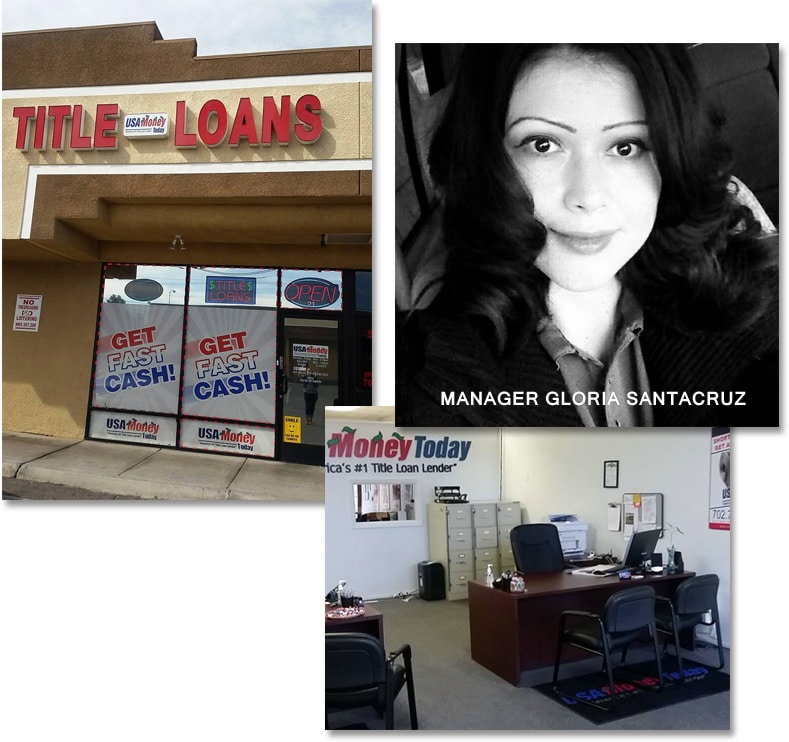

Photo Gallery

Take A Look At Our Title Loans Office For Trucks, Vans & Pickups

We frequently refinance Sunrise Manor truck title loans from other lenders. Refinancing involves restructuring your existing loan, potentially lowering interest rates, extending the repayment period, or adjusting other terms to better align with your current financial circumstances. However, the possibility of refinancing depends on different things, including your creditworthiness, and the equity in your vehicle. We encourage you to contact us as soon as possible to start this process or explore your available options. Keep in mind that while refinancing offers potential relief, it requires careful consideration and strategic planning to ensure it aligns with your long-term financial goals and minimizes the risk of further financial strain.